Beautiful Plants For Your Interior

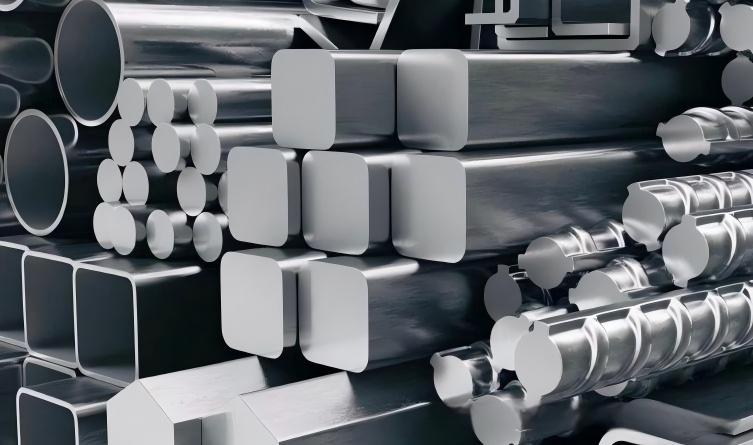

As of mid-July 2025, the global aluminum profile industry faces a mix of challenges from trade policies and seasonal demand fluctuations. The U.S. announced plans to impose a 30% tariff on aluminum products imported from Mexico and the EU starting August 1, with the EU vowing retaliatory measures if necessary. This development is expected to disrupt international supply chains, particularly affecting exporters in China, the world’s leading aluminum producer.

Domestically, China’s aluminum processing sector is grappling with a deepening off-season. Overall operating rates for aluminum profile manufacturers remained flat at 49.5% this week, with automotive and photovoltaic (PV) frame segments hit hardest. PV frame producers reported reduced orders and widespread “price-for-volume” strategies to sustain operations, while (construction profiles) saw muted order expectations amid sluggish construction activity. Inventory levels tell a mixed story: domestic electrolytic aluminum social stocks fell by 12,000 tons to 466,000 tons, but aluminum rod inventories rose by 6,500 tons to 160,000 tons, reflecting weak downstream consumption

Industry structure data highlights regional concentration in eastern China, with Jiangsu, Zhejiang, Shandong, and Guangdong provinces hosting major players like (Tianshan Aluminum) and (Nanshan Aluminum). Leading listed companies, including (Chinalco) and (Yunnan Aluminum), reported 2024 aluminum-related revenues exceeding RMB 30 billion, though profitability varied widely across product lines

Technological advancements and sustainability efforts continue to shape the sector. Gold Apple Aluminum Group, a Guangxi-based manufacturer, emphasized its new energy aluminum profile customization services and eco-friendly surface treatment technologies, such as nickel-salt electrophoresis, to meet green building standards. Meanwhile, industry analysts at (Guohai Securities) maintained a “recommended” rating for the sector, citing long-term demand resilience in new energy and transportation, despite near-term headwinds from tariffs and (off-season) pressures.

Key Challenges Ahead:

- Trade tensions: U.S.-EU-Mexico tariff disputes may reshape export flows.

- Demand recovery: Uncertainty over construction and automotive sector rebounds in Q3.

- Raw material costs: Alumina prices remain volatile amid supply adjustments in Guinea and Australia