Beautiful Plants For Your Interior

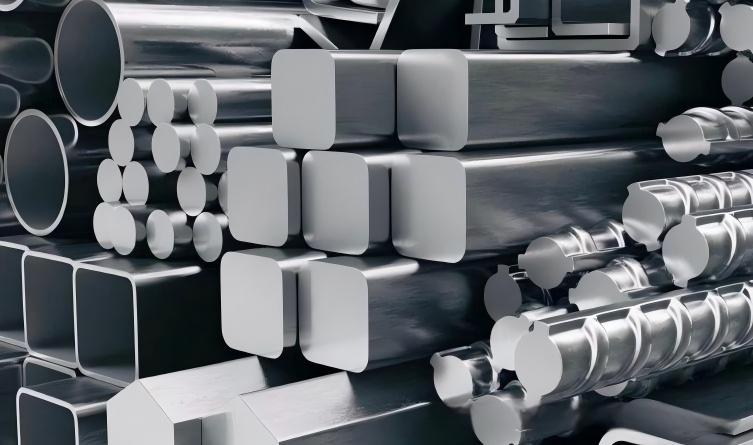

The US aluminium industry has been continuously developing over the past 25 years and has transformed its business into a global powerhouse in midstream and downstream aluminium production and recycling – having invested over 10 billion US dollars in its domestic business over the past decade. Meanwhile, the steady growth of domestic demand and the decline in the footprint of primary aluminium production have led the industry to import approximately 4 million tons of primary aluminium (or unwrought aluminium) – mainly from long-term trading partner Canada.

Expand the supply chain path

Achieving self-sufficiency in aluminum in the United States will require time, money, and commitments from both the public and private sectors to build new smelters and recover more aluminum. This white paper focuses on three main approaches to addressing the industry’s metal supply issues, including expanding primary aluminum production, increasing domestic scrap recycling rates, and importing metals from Canada and other reliable trading partners.

1、Rebuild or restart idle primary aluminum smelters

Currently, less than half of the installed capacity of primary aluminum in the United States is in operation (due to a historic decline). Re-releasing this metal from the existing four smelters would require long-term, competitively priced power contracts and still require significant capital investment. Even so, restarting all the idle smelters would only meet about 15% of the current 4 million tons of metal supply gap. There are significant opportunities for establishing new aluminum smelting capacity in the United States. Two projects currently under discussion include Century Aluminum’s plan to build a smelter using funds from the US Department of Energy, and Emirates Global Aluminium’s reported investment plan to build a new US smelter. Building such facilities requires time (5-6 years), a large amount of capital investment (each facility $4-60 billion), long-term, competitive power contracts, and equivalent annual electricity consumption in Boston or Nashville. To fully meet the current metal demand, the United States needs to build approximately 5 smelters with a capacity of 750,000 tons each. Currently, the largest fully operational smelter in the United States is now only producing 220,000 tons. The huge power demand for primary aluminum production poses a unique challenge to industrial self-sufficiency. A new aluminum smelter consumes approximately 11 TWh of electricity, which is similar to the annual electricity consumption of major US cities such as Boston or Nashville. Additionally, for economic competitiveness, smelters need a contract of 10-20 years with an electricity cost of approximately $40/MWh. Technology companies currently promise to provide more than $115/MWh of electricity for AI data centers. According to the current trend line, the Energy Information Administration estimates that by 2035, the energy gap in the United States will reach approximately 50 TWh.

2、Recycle and reprocess more domestic waste aluminum

Although domestic primary production has declined in recent decades, the production of recycled (or reprocessed) aluminium has increased, reaching a record level by 2024. The energy intensity of recycled aluminium is approximately 95% lower than that of primary production, and it mainly relies on scrap aluminium as the input material. The capital intensity of building aluminium recycling facilities is also much lower. New sorting technologies can release more usable scrap aluminium. Collecting and recycling approximately 1 to 200 million tons of available waste materials that are currently landfilled or exported will fill 25% to 50% of the existing metal supply gap in the United States.

3、Import metals from reliable partners

As the industry strives to produce more domestic aluminum, obtaining affordable and reliable Canadian primary aluminum serves as an important bridge for metal supply and is also a cost-effective deal for the United States. The amount of aluminum imported by the United States from Canada each year is equivalent to the energy output of four Hoover Dams – typically much cheaper than importing electricity directly. Canadian aluminum smelters usually pay $25-40 per megawatt-hour, while in the United States it is $60-80 per megawatt-hour. Moreover, each job at a Canadian aluminum smelter supports approximately 13 downstream aluminum jobs in the United States. “Aluminum is a key material for the national economy and national security – from cars and cans to fighter jets, tanks and power grids, it can be found in every aspect,” said Charles Johnson, president and CEO of the Aluminum Association of the United States. “Even if we could flip the switch and start all idle aluminum smelters tomorrow, the U.S. industry currently cannot produce nearly enough metal to manufacture the products that Americans rely on. This new study shows that to achieve greater self-sufficiency, all of the above methods for energy, trade and recycling policies need to be adopted to ensure that American manufacturers have abundant and affordable metals. The Aluminum Association calls on policymakers to support the aluminum agenda in areas such as energy, trade and recycling policies to enhance the self-reliance of the U.S. manufacturing economy in this critical sector.”